The 3 Ingredients Credit Uninons Need for a Successful Program

Key Components for Streamlining Processes and Ensuring Impactful Outcomes

In the world of scholarship management, maintaining fairness, efficiency, and applicant security are essential to running a successful program. By understanding the foundational elements of a streamlined and equitable process, credit unions can create a meaningful and impactful experience for applicants, reviewers, and staff.

This webinar has concluded. Stay tuned for the next!

Webinar: 11/19/2024 at 2 pm CT

Webinar Highlights:

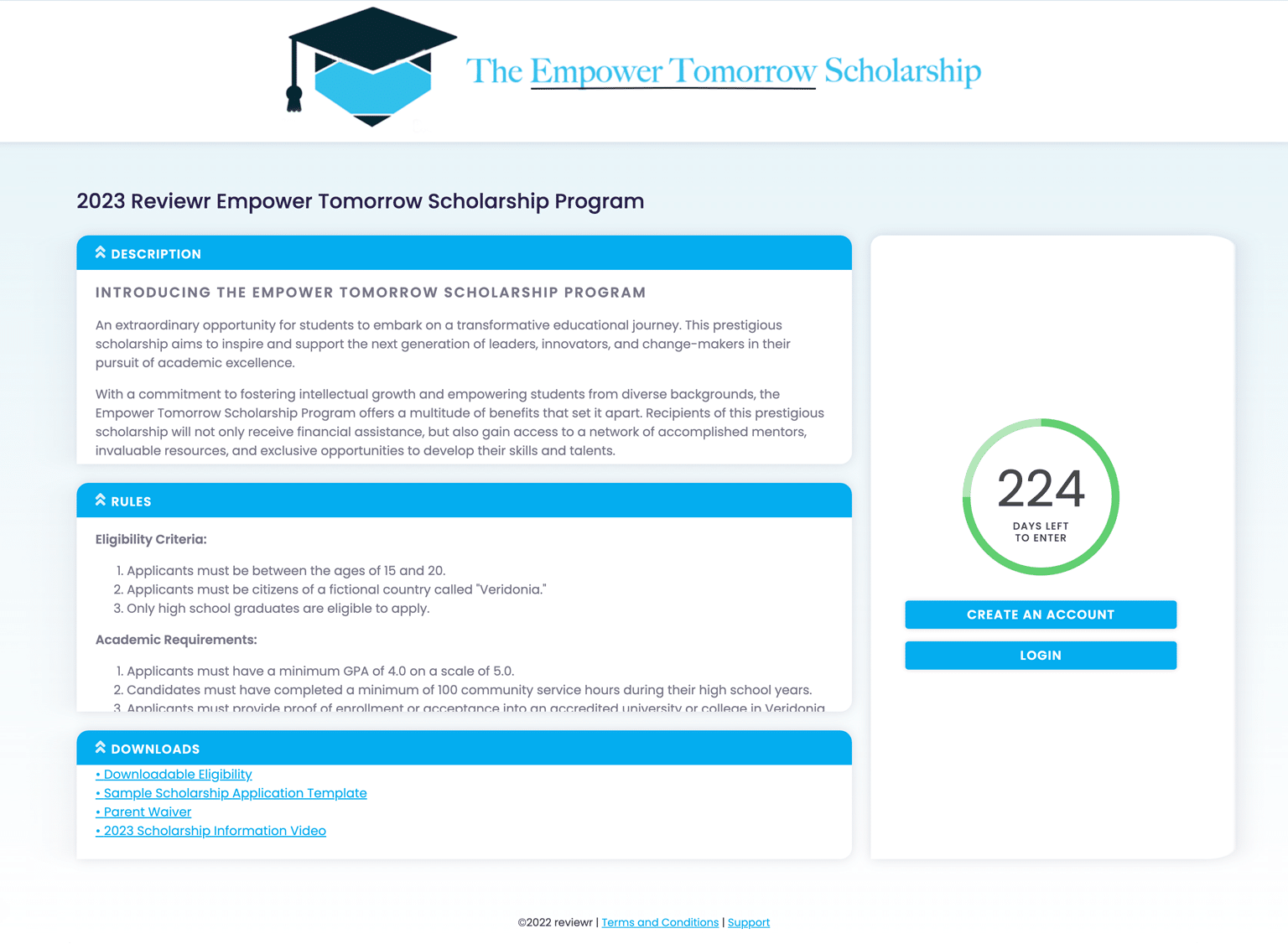

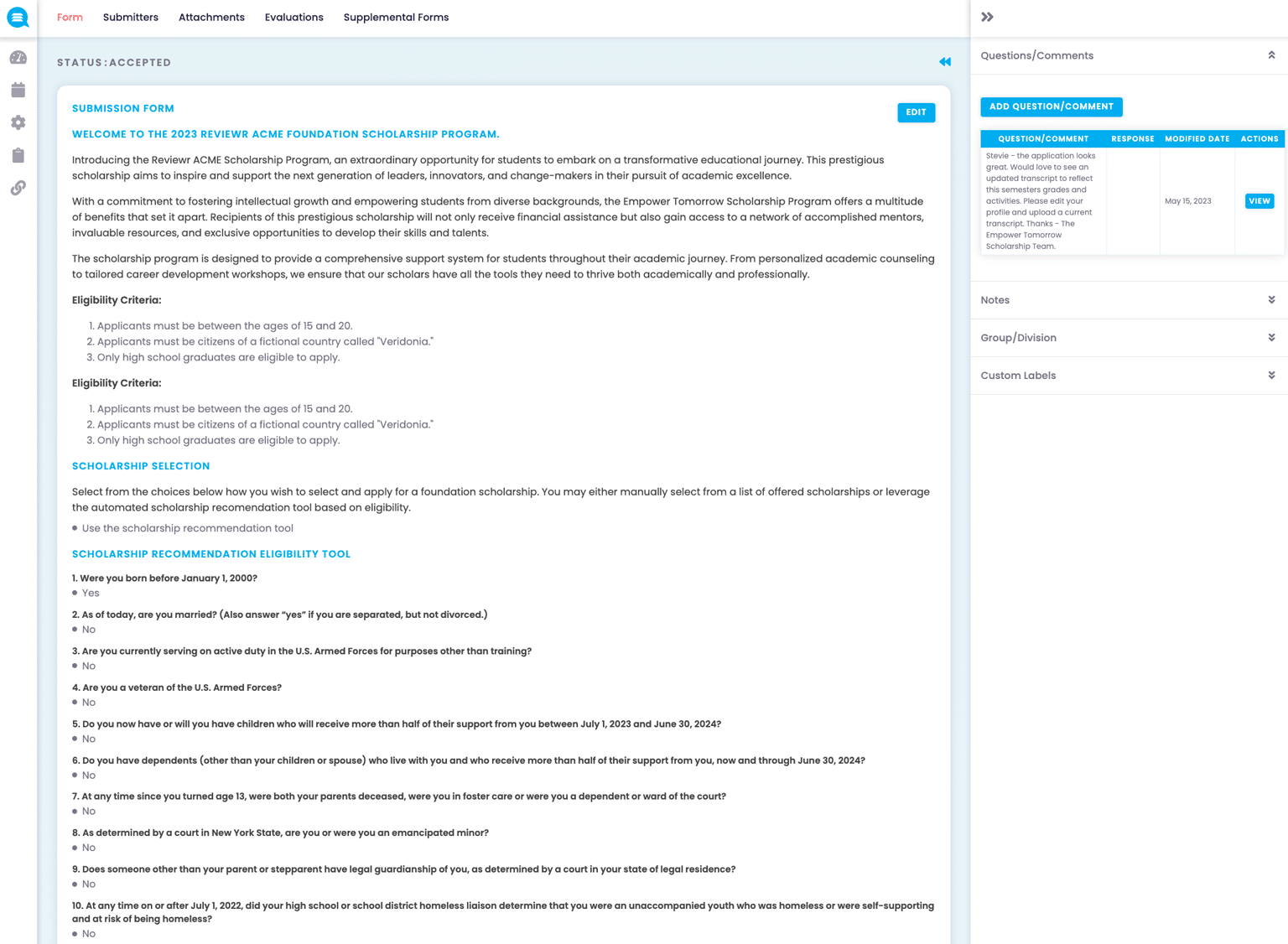

- Intuitive Application Platform: A streamlined, user-friendly application leveraging intelligent automations and a personalized experience. Gone are the days of using generic web forms – it’s essential to use a dedicates scholarship application tool.

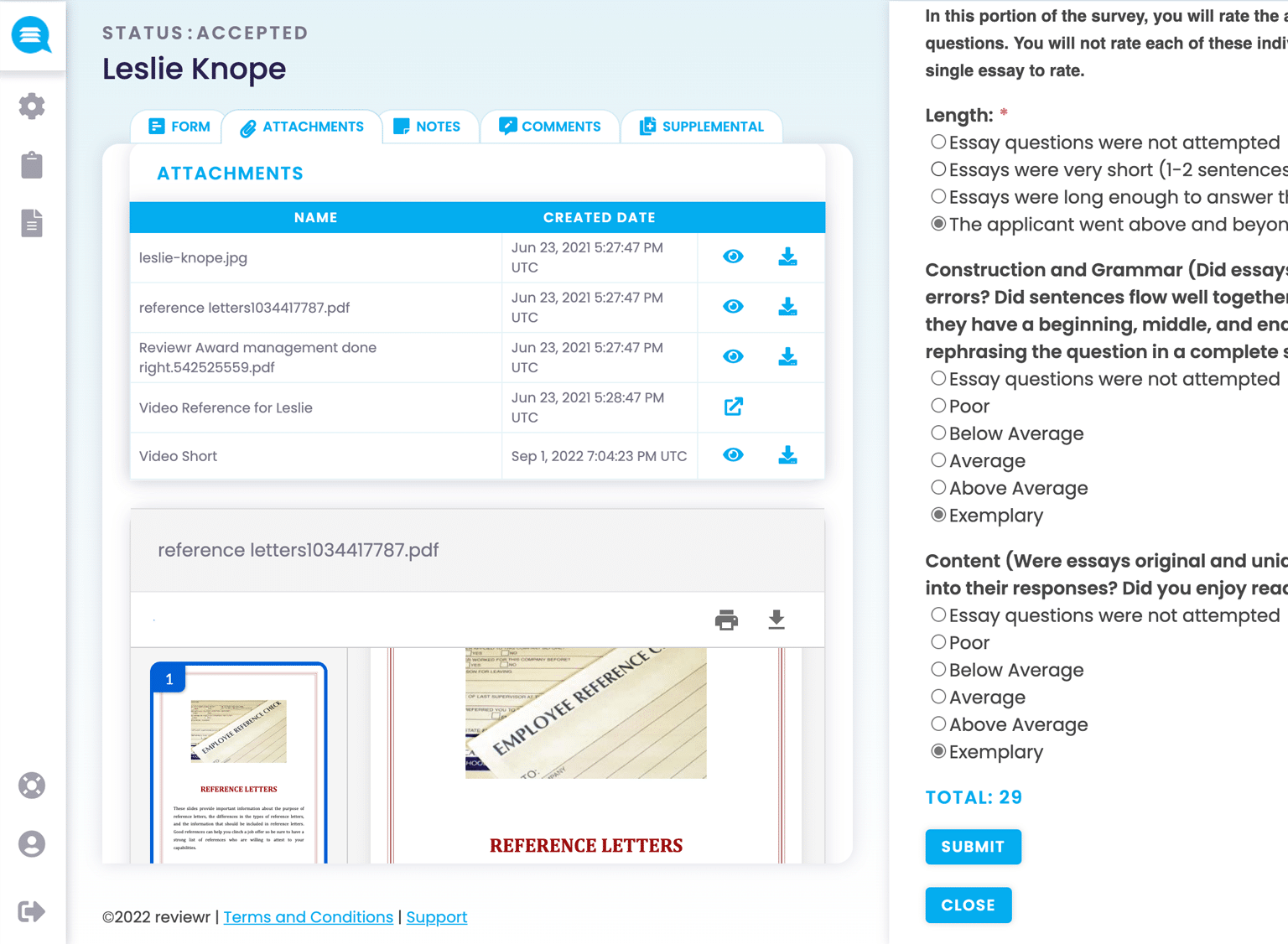

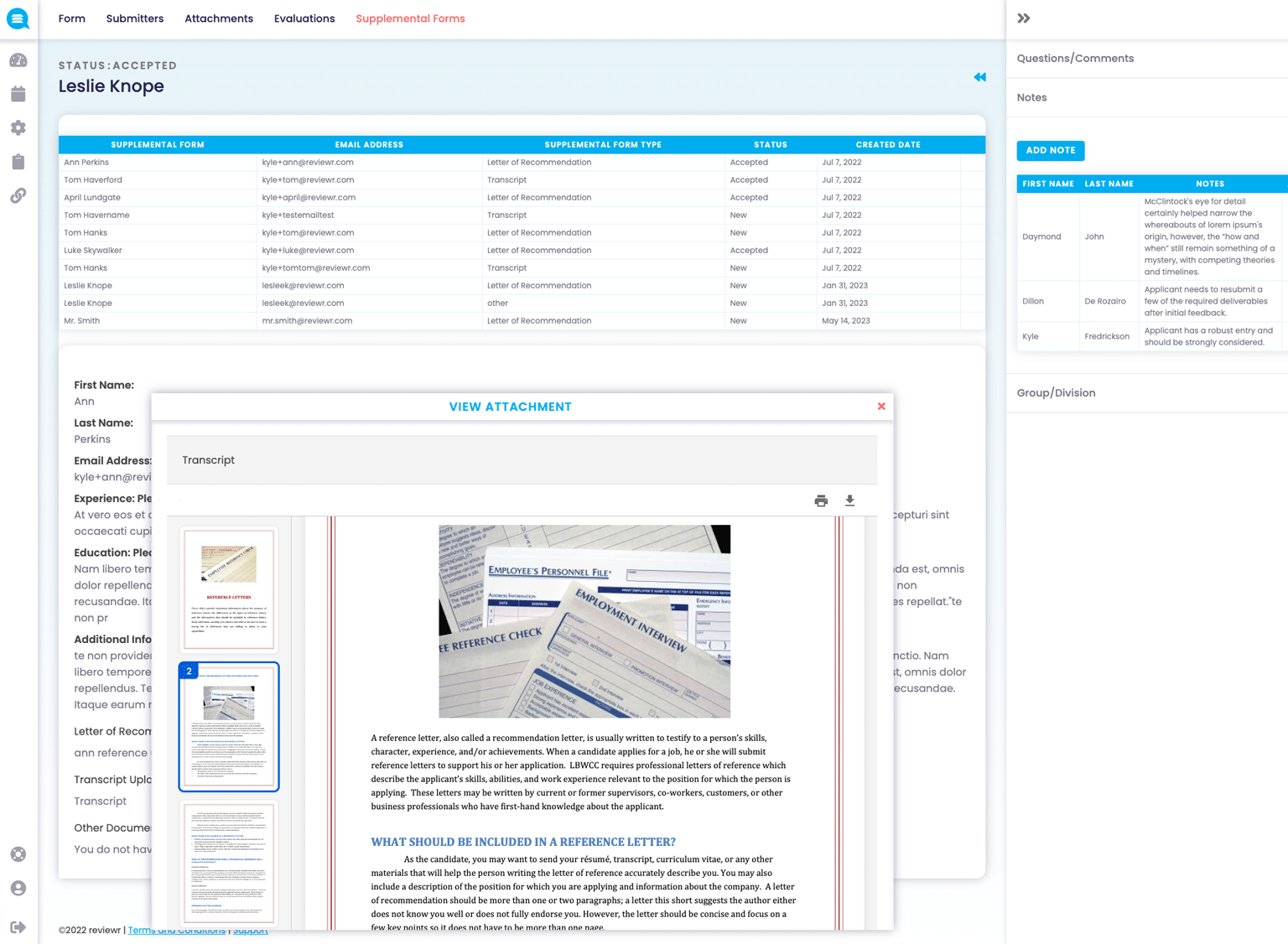

- Document Collection and Verification: Establish protocols for collecting, verifying, and securely storing required documents, such as transcripts, recommendation letters, and essays.

- Clear Eligibility Criteria: Transparent, well-defined eligibility requirements, accessible from the start, help applicants determine if they are a good fit.

- Automated Reminders and Notifications: Timely reminders for deadlines and updates keep applicants engaged and informed throughout the process.

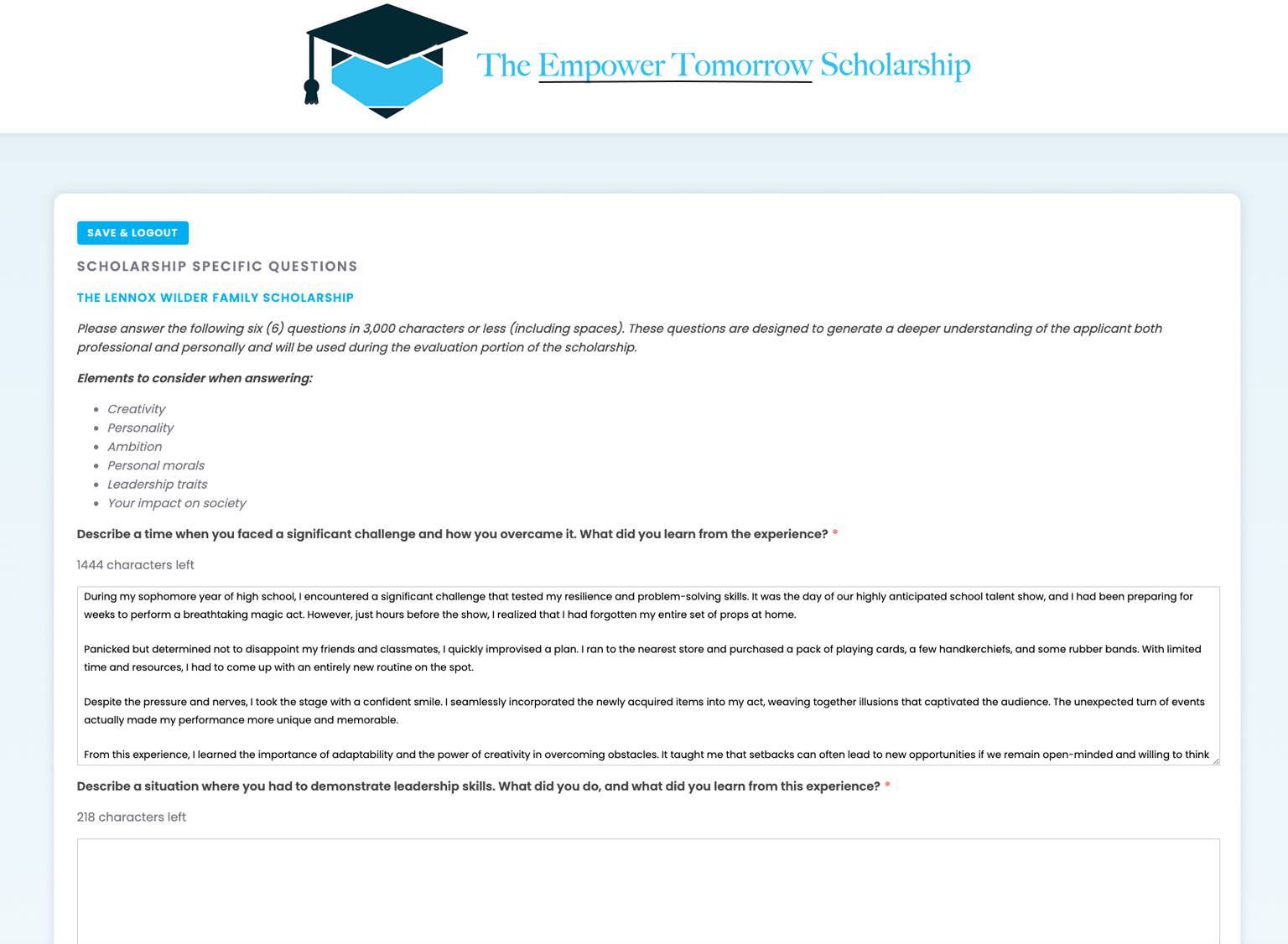

- Modern user experience: Dedicated tools for the right task at the right time. Empower applicants to save and logout, work at their own pace, work via a mobile device, etc.

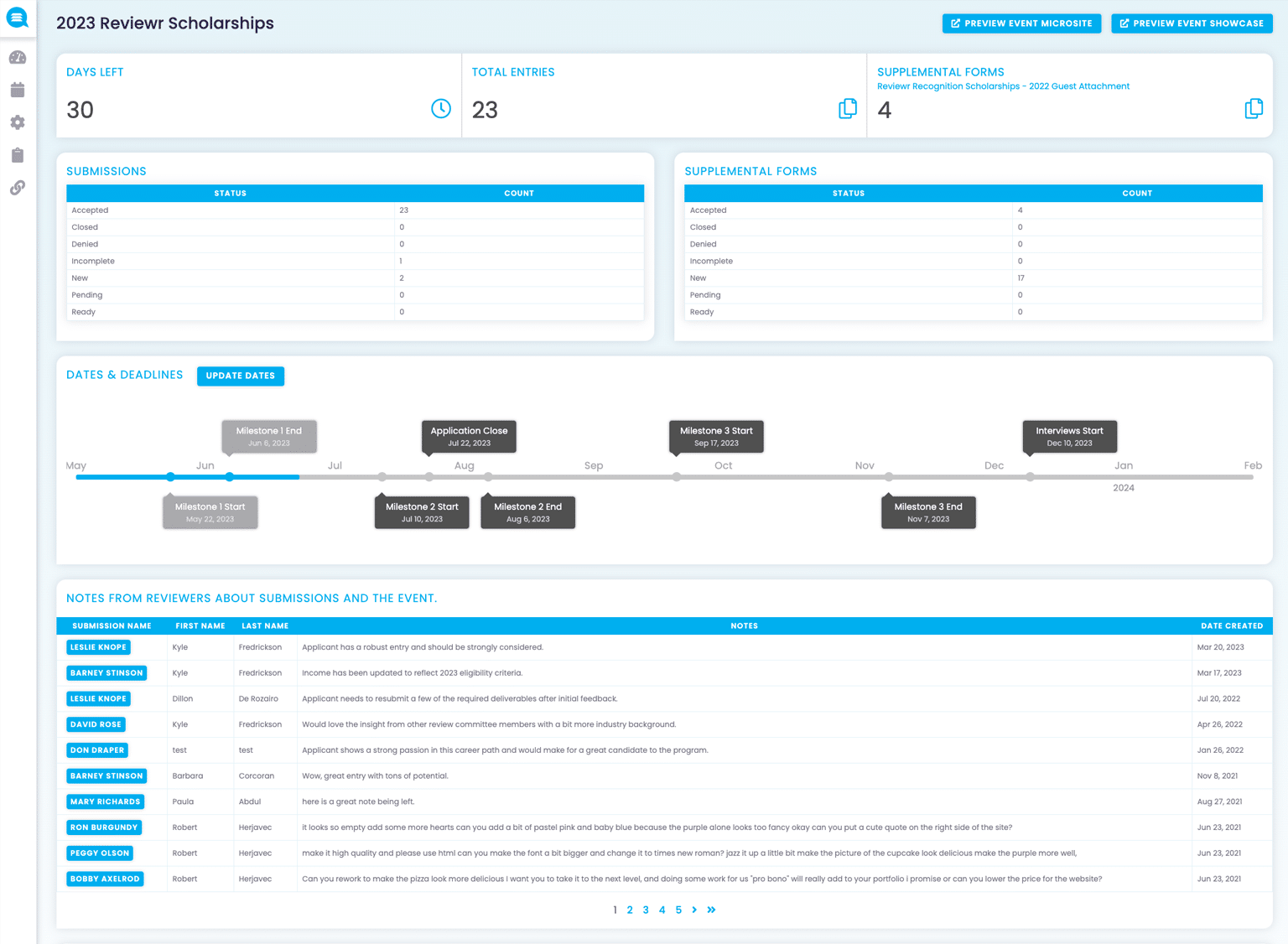

Real-Time Reporting and Analytics

- Application Metrics: Instantly view metrics such as total submissions, incomplete applications, and eligibility statistics. Monitor trends and make data-driven decisions.

- Exportable Data and Customizable Reports: Generate reports for board meetings, grant funding requirements, or annual reviews, with customizable data fields and export options.

Application and Submission Management

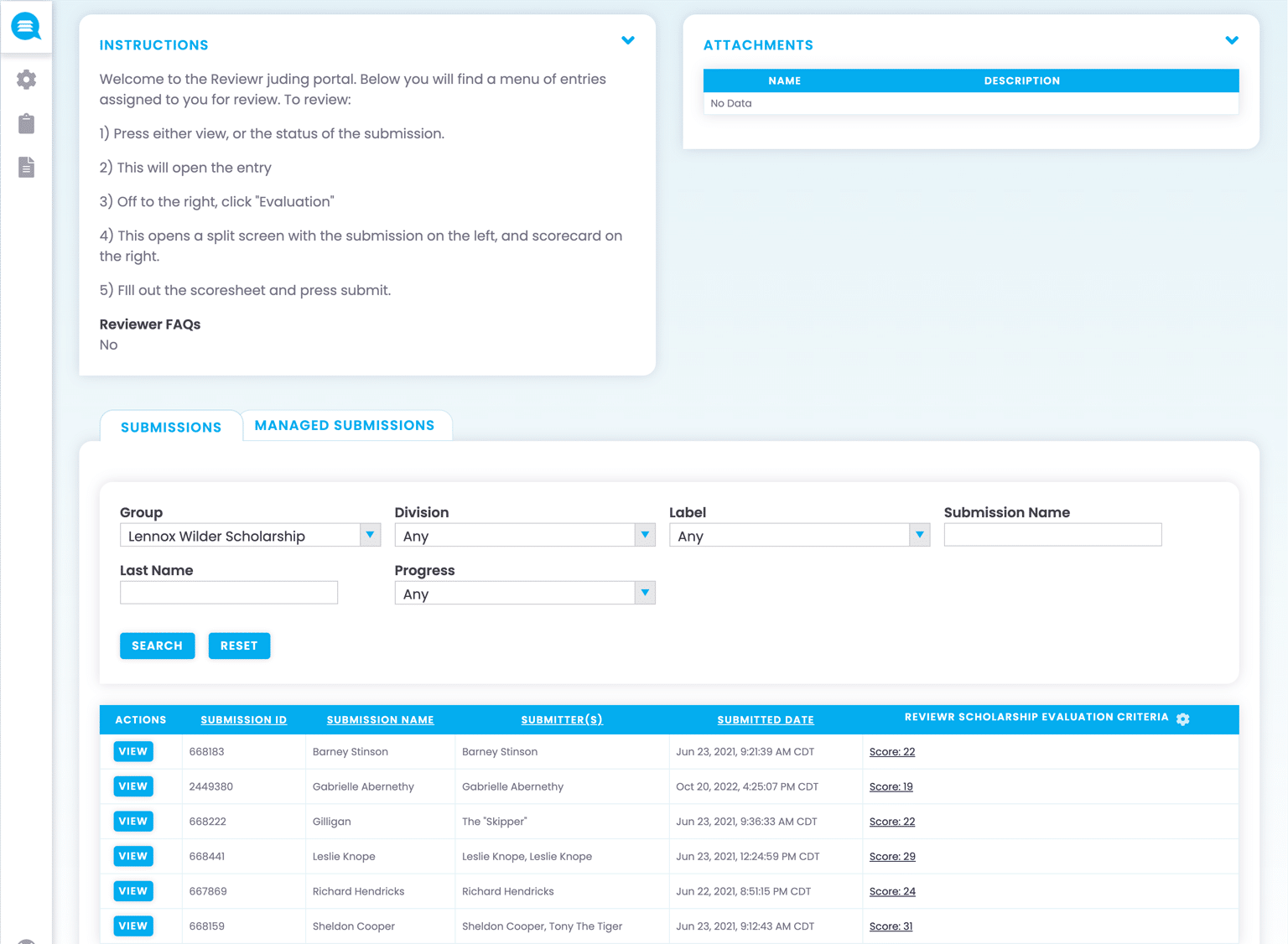

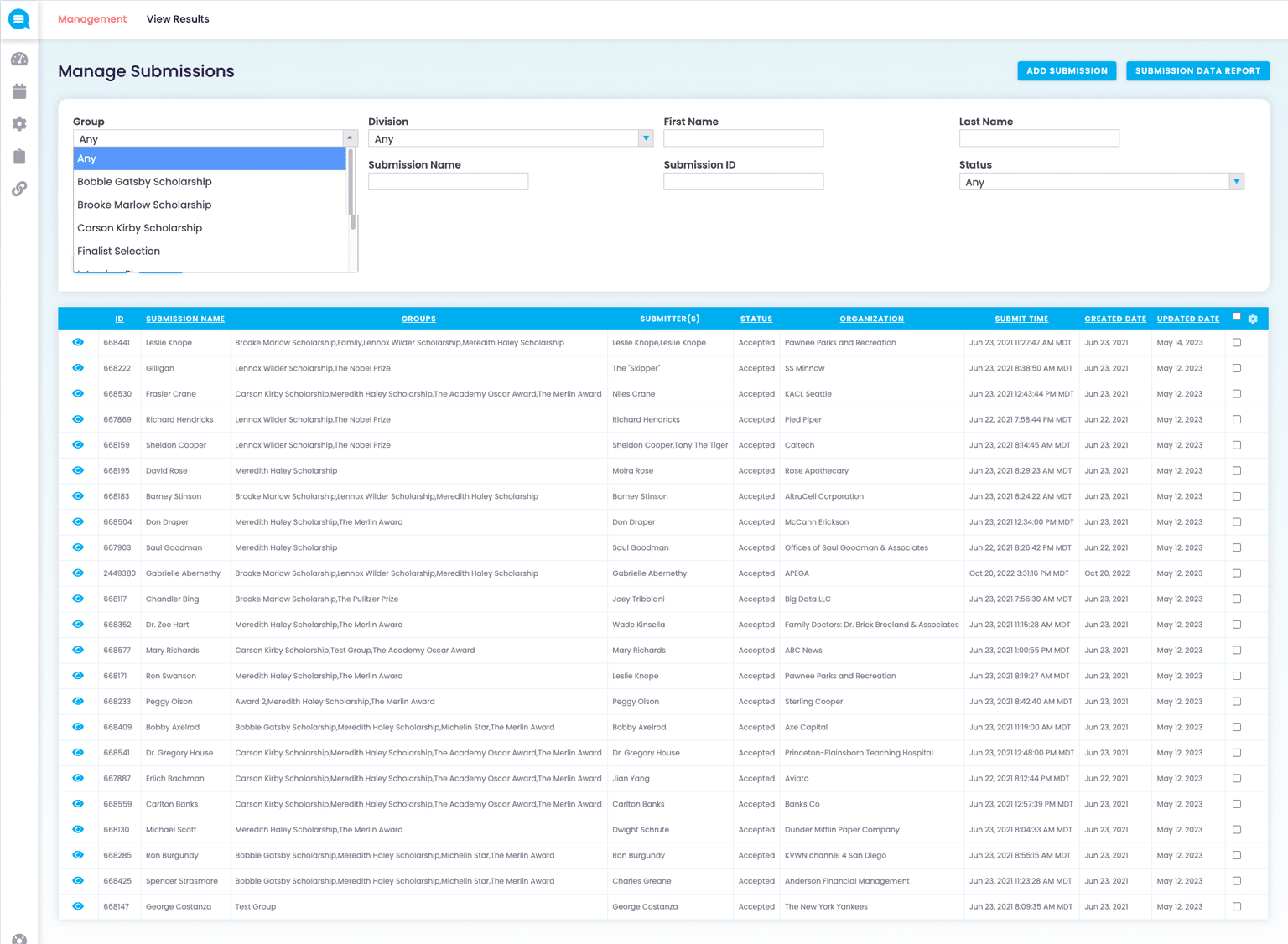

- Comprehensive Submission View: Access an at-a-glance overview of all submissions, including each application’s status, progress, and any incomplete sections that need follow-up.

- Searchable applicant menu: Use search and filtering capabilities to quickly locate applications by name, date, eligibility criteria, or review status.

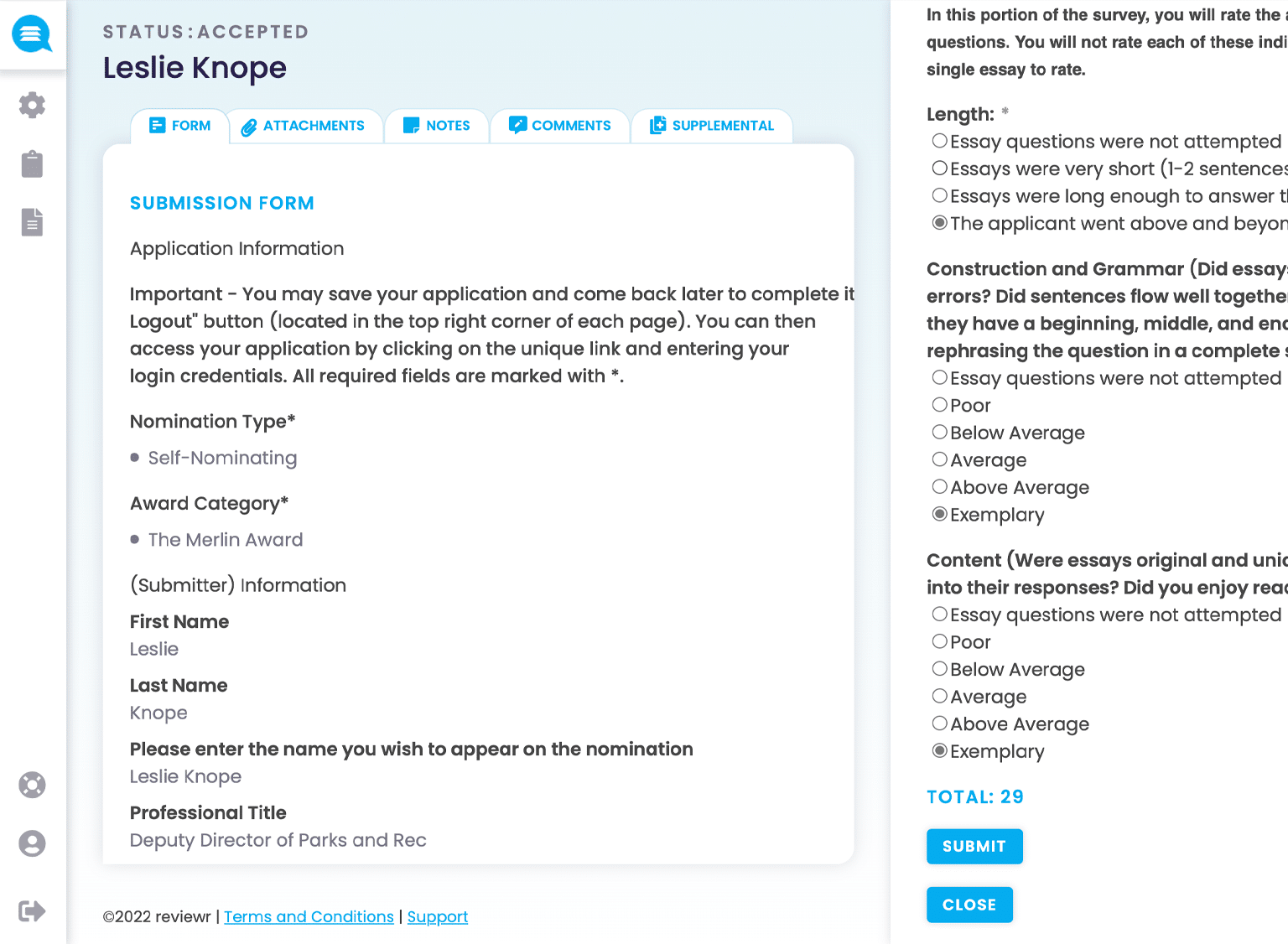

- Centralized Applicant Records: View detailed profiles for each applicant, including personal information, academic history, submitted documents, and recommendation letters.

- Document Repository: Access all uploaded documents, such as transcripts, essays, and references, organized within each profile.

Staff and User Management

- Role-Based Access Controls: Define access levels for various roles (e.g., reviewers, administrators, etc), ensuring that sensitive data is only accessible by authorized personnel.

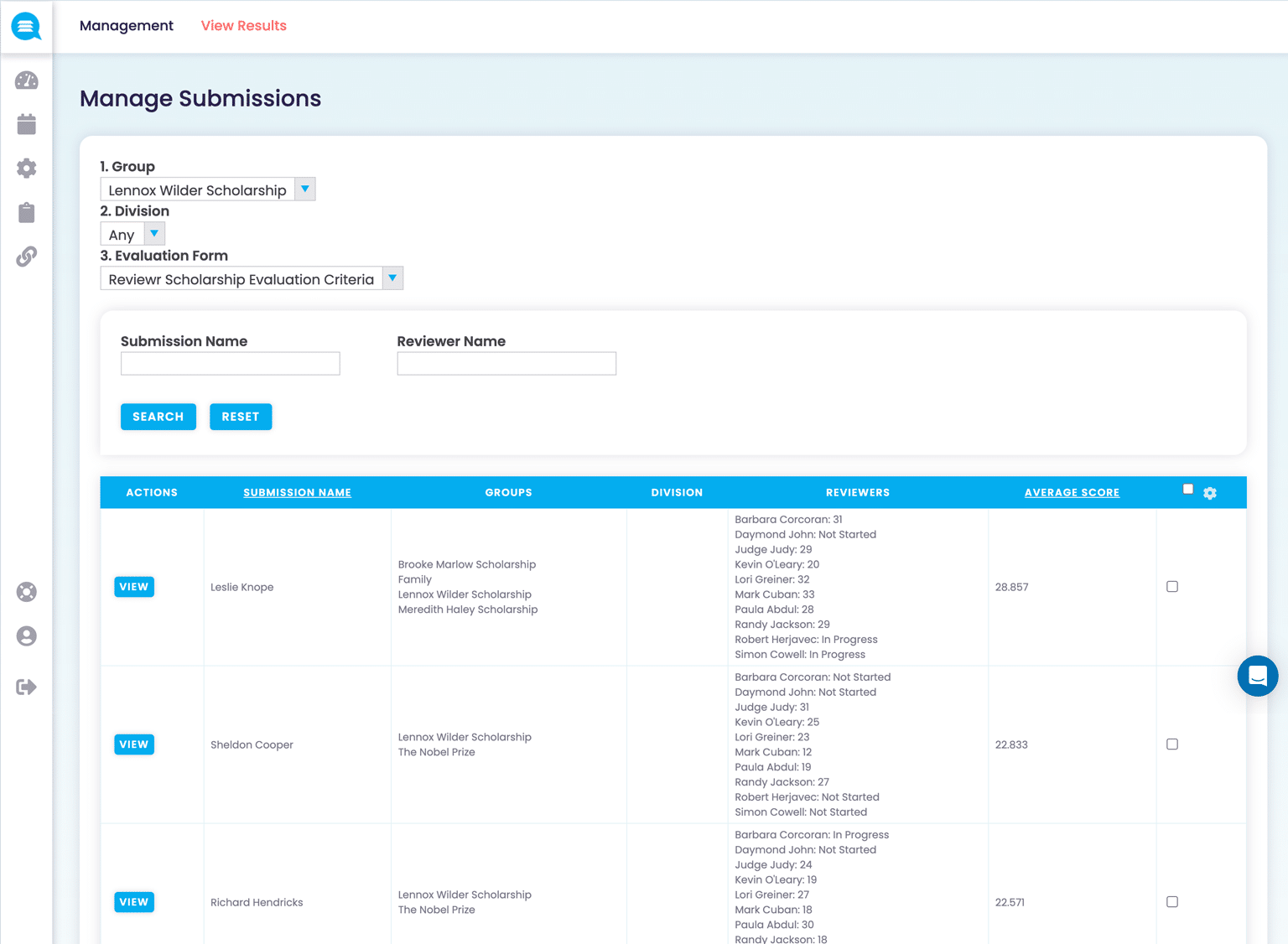

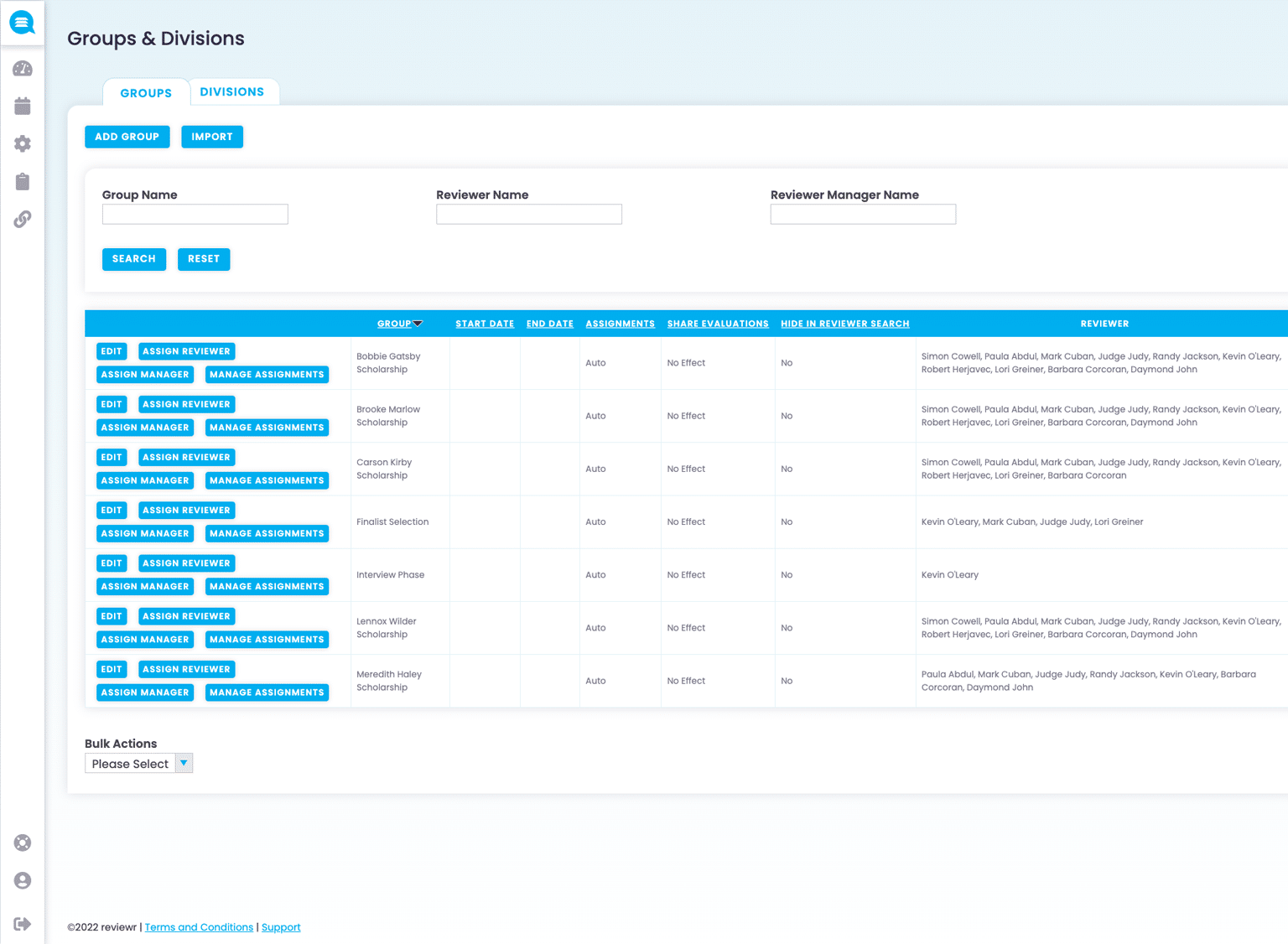

- Reviewer Assignment and Progress Tracking: Assign submissions to reviewers based on criteria like expertise or demographic match, and monitor progress to ensure timely reviews.

- Collaboration and Communication Tools: Enable internal messaging and collaboration, allowing staff to coordinate seamlessly on tasks like scoring, applicant inquiries, and follow-up

Workflow Automation and Customization

- Automated Review Assignments: Set up rules-based assignments to automatically distribute applications to reviewers based on qualifications or priority.

- Scoring Rubrics and Custom Scorecards: Create and apply custom scorecards to standardize the review process, ensuring consistent, unbiased scoring.

- Email and Notification Workflows: Automate notifications for each phase of the application process, from submission confirmations to deadline reminders and award announcements.

Security and Compliance Management

- Data Privacy and Compliance Tools: Ensure that applicant data is managed in compliance with relevant regulations (e.g., FERPA, GDPR), with automated data redaction options where needed.

- Documented Audit Trails: Maintain records of every interaction and change within the system, providing transparency for audits and data governance.

- Secure Access and Authentication:

Consolidated Dashboard for Overall Program Management

- Program Overview: Display a consolidated view of all active scholarship programs, upcoming deadlines, and key metrics in a single dashboard.

- Feedback Collection and Continuous Improvement: Gather feedback from applicants, reviewers, and program staff, allowing for iterative improvements to the application process.

Integrated Communication Tools

- In-Platform Messaging with Applicants: Enable direct communication with applicants for document requests, clarification on submissions, or answering questions.

- Mass Email Capabilities: Send notifications or reminders in bulk to specific applicant segments, such as incomplete applications or shortlisted candidates.

- Automated Status Updates: Provide applicants with updates at each stage of the review process, ensuring transparency and engagement.

1. Automated Redaction of Personally Identifiable Information (PII)

- Data Privacy and Unbiased Judging: Automatically redact applicant information such as names, gender, address, and other identifiable details from submissions before reviewers see them. This allows for evaluations based solely on the applicant’s merit, reducing unconscious biases.

2. Randomized Submission Distribution

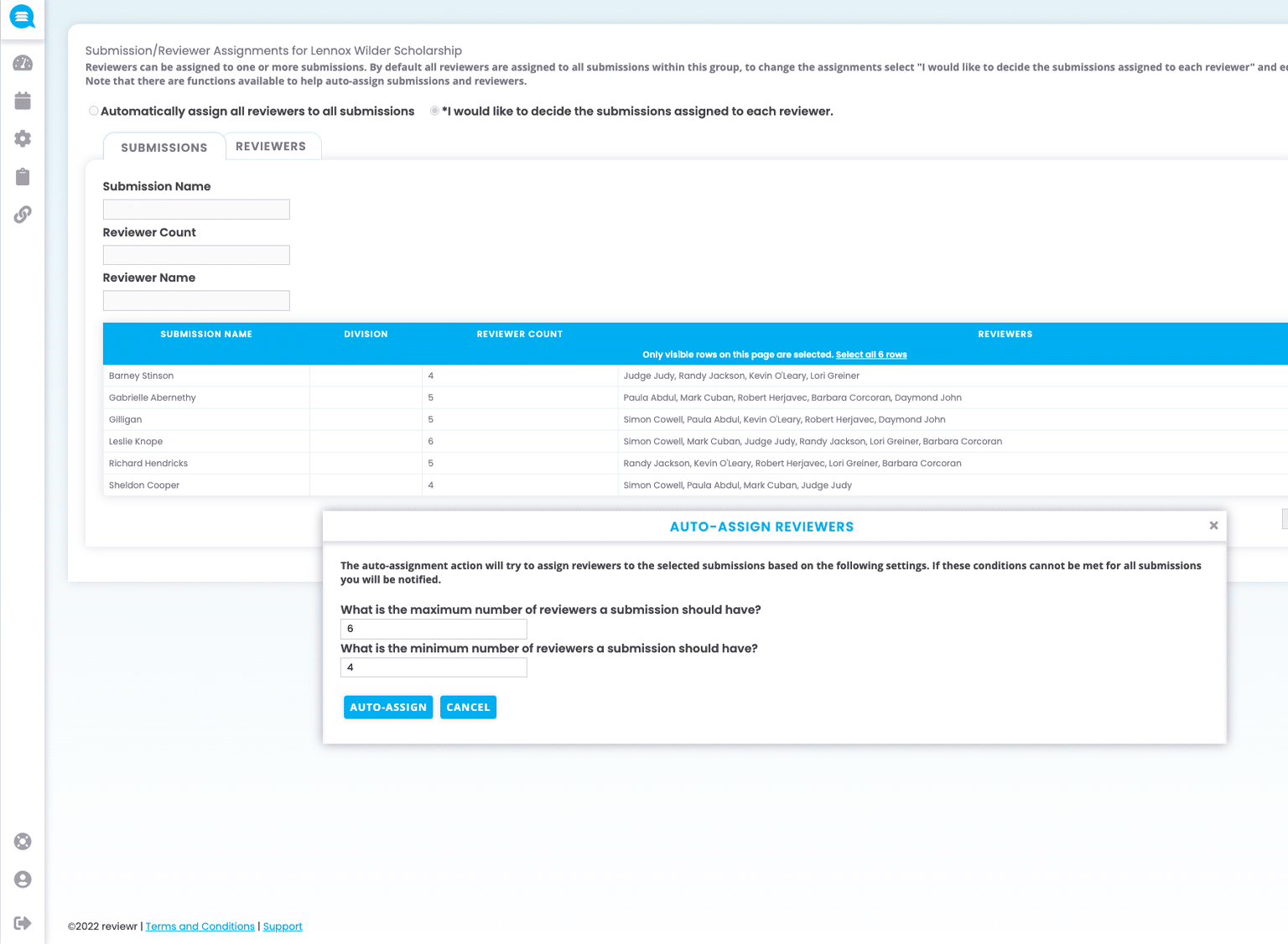

- Equal Opportunity Review Assignments: Utilize a randomized distribution system to assign applications to reviewers, ensuring a balanced and unbiased distribution that allows each application to have an equal chance of being evaluated by different reviewers.

- Assignment Flexibility: For larger programs, administrators can set rules for random assignment based on criteria such as location, expertise, or project focus, while still preserving randomness to avoid any favoritism.

- Consistent Reviewer Workload: Assign each application to a set number of reviewers to ensure every applicant is evaluated the same number of times. This prevents any applicant from receiving more or fewer reviews, standardizing the evaluation process and improving fairness.

3. Quantitative Scoring Rubrics

- Clear and Consistent Evaluation Metrics: Develop standardized rubrics with predefined scoring categories (e.g., impact, financial need, academic performance) to establish a uniform evaluation framework across all reviewers.

- Weighted Scoring Options: Allow for category weighting, so certain aspects (e.g., community impact) can carry more significance based on program priorities, creating a more nuanced evaluation.

- Integrated Scorecards: Use digital scorecards linked to the rubric, allowing reviewers to rate each criterion on a predefined scale, add comments, and submit scores directly within the portal. This simplifies scoring and minimizes inconsistencies.

4. Normalization Reporting for Consistent Scoring Across Reviewers

- Detect Reviewer Scoring Tendencies: Automatically track and analyze each reviewer’s scoring patterns over time to detect tendencies, such as those who score consistently higher or lower than average.

- Normalization Adjustments: Apply normalization algorithms to account for any tendencies among reviewers. If certain reviewers typically score higher or lower, the system can adjust scores slightly to align with the program’s average, ensuring fairness for applicants.

- Bias Detection: Generate reports that highlight outliers or potential scoring inconsistencies, allowing administrators to proactively address any significant biases before final decisions are made.

- Transparency for Continuous Improvement: Provide reviewers with anonymized feedback on their scoring patterns compared to program averages, helping them understand and adjust their scoring tendencies for future rounds.

6. Transparent Feedback and Oversight Mechanisms

- Real-Time Reviewer Progress Tracking: Track each reviewer’s progress and scoring trends within the command center to ensure adherence to deadlines and detect any scoring irregularities early in the process.

- Optional Feedback Submission: Provide an option for reviewers to submit feedback or comments for each applicant, giving applicants actionable insights when possible and adding depth to the scoring process.

- Audit Trail for Accountability: Maintain an audit trail that documents all reviewer scores, comments, and application status changes, ensuring accountability and transparency for any necessary compliance or audit review.

8. Final Consensus and Decision-Making Workflow

- Facilitated Deliberation for Finalists: For top applicants, enable a final review or committee discussion phase where reviewers can see normalized scores, read other reviewers’ feedback, and discuss the merits of each application.

- Automated Shortlisting Based on Scores: Set score thresholds to automatically shortlist applications, allowing administrators to focus attention on top contenders without manual sorting.

- System-Generated Recommendations: Use aggregated and normalized data to provide recommendations on finalists, allowing the decision-makers to make fair, data-informed choices.

Take a quick tour

The experience your deserve

Why Credit Unions use Reviewr?

Reviewr for Credit Union Scholarships: Scholarships, powered through Reviewr, help credit unions drive deeper member engagement and community impact – leading to increased asset growth, regulatory compliance, and community trust.

Scholarships are a direct way of giving back to the community. It shows credit unions are committed to the betterment and success of its valuable members – leading to increased membership. As Membership increases, more individuals will open accounts, take out loans, and leverage other financial services.

According the the World Council of Credit Unions – the average age of a credit union member is 53, posing long-term sustainability challenges. Scholarships attract a younger generation of membership while leading to increased membership via referrals as well as driving financial literacy and education in a target demorgraphic.

Scholarships from credit unions are a direct investment into the community – helping members achieve their educational goals, which lead to better job opportunities, improved quality of life, and local economic impact. By supporting members educational pursuits, credit unions lay the groundwork for long-term relationships. Members will appreciate the credit union’s efforts leading to increased loyalty and trust – empowering positive publicity and community brand image.

In a highly regulated industry Reviewr provides both the data security and audit proof of process critical to the success of a scholarship. Leveraging proof of process functions credit unions will ensure a fair, non-bias, and compliant scholar selection process while also ensuring a feedback loop for self development and growth. As a SOC2 certified platform, Reviewr gives both credit unions and the community peace of mind that robust data security measures are in place to handle sensitive member information.

Reviewr provides the modern consumer the digital accessibility desired by the modern consumer. This leads to a better participant and volunteer experience, streamlined operations, data-driven insights, and the toolbox credit unions seek for building a digital brand presence.

The Scholarship Applicant Experience

Empower scholarship applicants with the modern and user friendly experience they desire – promoting more engaged participants, increased participation rates, better quality applications, and reduced support.

The Scholarship Management Experience

Increase scholarship management efficiency by an average of 84%, saving time and money that can be better allocated to other high-impact activities. Manage the entire scholarship lifecycle in one place with a dedicated scholarship management system – eliminating the back and fourth between paper, email, web forms, spreadsheets, exporting, databases, file sharing, and more.

Streamline your review process with Reviewr’s dynamic feature for assigning scholarship applicants to review committees, a vital tool within our comprehensive scholarship management software. This feature offers versatile assignment options to accommodate your program’s unique needs, ensuring a fair and unbiased evaluation process. Manually assign individual scholarship applications to specific committee members for a tailored review approach, or utilize groupings to distribute batches of applications efficiently among different reviewers. For a more impartial distribution, leverage the automated assignment system, which randomly allocates a set number of submissions to judges, mitigating potential biases and promoting a fair assessment environment. This assignment flexibility ensures that each application is reviewed thoroughly and fairly, enhancing the integrity and credibility of your scholarship program.

The Scholarship Review Experience

Reduce scholarship evaluation workloads by 79% and promote a professional and time-conscious online review and selection experience resulting in higher quality reviews, feedback, and increased year over volunteer retention. Ensure program integrity and confidence through non-bias, accurate, transparent, consistent, and data-driven decision-making.